Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

October 2024 market review: International

Upcoming US elections and escalating geopolitics in the Middle East dominated the markets. Read our October 2024 market review.

Weighing campaign promises

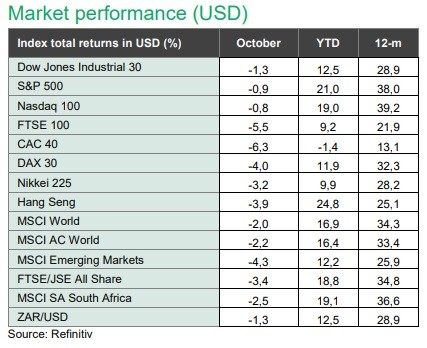

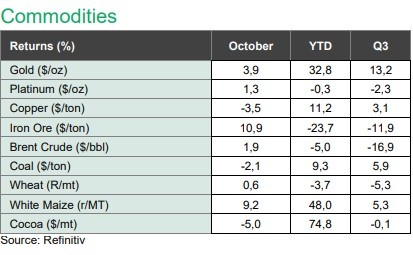

After a strong third quarter, global equity and bond markets retreated in the face of mixed economic data and event risk. Upcoming US elections dominated, with markets assessing the possibility and impact of higher tariffs and larger fiscal deficits. Geopolitics in the Middle East escalated, with Iran launching a missile attack on Israel. In a moment that could have broadened the conflict meaningfully, Israel retaliated, but opted to give critical nuclear and oil sites a miss. Despite daily volatility, weaker global demand prospects curtailed the oil price increase to 1,9% over the month. The IMF published its latest World Economic Outlook, keeping economic growth forecasts steady, just above 3,0%, alongside lower global inflation projections.

US headline inflation declined to 2,4% y-o-y in September, marginally ahead of expectations, while core inflation edged higher to 3,3%. Producer prices printed at 1,8 from 1,9% the prior month, coming in ahead of expectations.

Data for the US personal consumption expenditure price index (PCE) was recorded at 2,1%, the lowest level since February 2021 and in line with expectations. The annual rate for core PCE (the Fed’s preferred measure of inflation) remained steady at 2,7%. Third quarter economic growth for the US recorded at a healthy 2,8% (annualised), while strong non-farm payroll figures for September and upward revisions to July and August figures saw markets pull back expectations for the interest rate cutting cycle. After several weeks, strikes at US ports were resolved, a positive for congestion and supply chain friction.

China recorded economic growth of 4,6% y-o-y in the third quarter, weakening from the previous quarter and below the 5,0% growth target. Chinese activity gauges have languished against a deflationary and meagre demand backdrop but improved into October. Policymakers announced various fiscal measures over the month, the magnitude of which disappointed the market. More information is expected from the National People’s Congress (NPC) Standing Committee meeting in early November.

UK inflation printed at 1,7% in September from 2,2% the previous month, with wage growth continuing to slow. The newly elected Labour party delivered its first budget, which outlined higher taxes and borrowing to fund public infrastructure and services, notably health and education. The Office of Budget Responsibility (OBR) believes the budget will provide a short-term boost but is unlikely to lift economic growth over the next five years. Inflation for the Euro area moderated to 1,8% y-o-y from 2,2% the previous month, printing below the 2,0% inflation target for the first time in three years. In line with expectations, the European Central Bank (ECB) cut the policy rate by 25bps.

US earnings season started on a mixed note, with earnings from several technology companies and the large banks beating expectations. On average, however, analysts lowered forward guidance. The US 10-year bond yield steadily moved back above the 4,0% mark, ending the month at 4,3% as markets digest resilient US economic and polling data. The Bloomberg Global Aggregate Bond index declined 3,4%, bringing the return year to date to a marginal 0,1%. With geopolitics still prominent and interest rates trending lower, gold remained well supported, gaining 3,9% in October and bringing the returns since the start of the year to 32,8%. The US dollar gained 3,2% in October, helping the greenback appreciate by 2,6% year to date on a trade weighted basis.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.