Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

December 2024 market review: International

The global political backdrop provided ongoing surprises during December. Read our international market review.

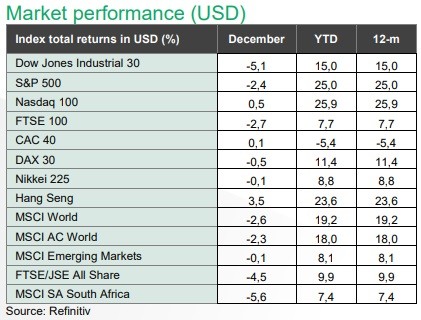

A strong year for risk assets

Despite a weak fourth quarter, risk assets delivered strong returns in 2024. US equity markets outperformed other developed market peers over the year, supported by technology stocks like Nvidia, which gained 171,2%. Chinese equities made a comeback into year end, supporting a positive full year figure for emerging markets. Sovereign bond markets, however, took a turn as global bond yields rose in December and into 2025 as investors pared back interest rate expectations, pricing the looming risks from increased global trade tariffs on inflation and global growth, alongside expected fiscal largesse.

The global political backdrop provided ongoing surprises. South Korea’s president tried to declare martial law but was later impeached by opposition parties. The French minority government collapsed and culminated in the resignation of the Prime Minister. Pronouncements from US president elect, Donald Trump caused a stir, with a warning that BRICS countries would be imposed a 100% tariff should they consider pursuing a BRICS currency. In Syria, the Assad regime was overthrown, marking the end of the family’s 50- year rule. Politically and otherwise noteworthy, a five-year deal, which saw Russian gas delivered to EU states via Ukraine, expired at the end of the year. Although nowhere near the peaks of the Ukraine invasion in 2022, prices remain sensitive to supply consideration with European gas prices increasing 53,4% in 2024. OPEC+ members extended production cuts to end March 2025, in line with expectations while also downgrading their projections for global oil demand. The oil price increased by 2,3% over the month but ended the year down 3,1%.

US headline inflation increased to 2,7% y-o-y in November, broadly in line with expectations, while core inflation remained steady at 3,3%. Producer prices printed at 3,0% from 2,4% the prior month, coming in ahead of expectations. Data for the US personal consumption expenditure price index (PCE) was recorded at 2,4% from 2,3% the prior month, below expectations. The annual rate for core PCE (the Fed’s preferred measure of inflation) remained steady at 2,8%. The US Federal Reserve (US Fed) lowered the policy rate by 25bps, in line with market expectations. The accompanying statement and economic projection

were, however, seen to be hawkish.

Federal Reserve Chair, Jerome Powell remarked on a resilient US economy and labour market data which may precipitate fewer interest rate cuts, especially with signs that disinflation appears to be slowing, ahead of reaching the inflation target. Markets pulled back expectations for the interest rate cutting cycle with the possibility of a slower pace in interest rate cuts in the 2025. The US 10-year bond yield ended the month higher at 4,6%.

December was a busy month for policy makers. Inflation for the Euro area increased to 2,4% y-o-y from 2,2% the previous month, as lower energy prices roll off the yearly numbers. The European Central Bank (ECB) cut interest rates by 0,25%, expressing concern on economic momentum against a backdrop of ongoing political uncertainly in France and Germany. The Bank of Canada and Swiss National Bank both cut policy rates by 50bps, while Brazil raised interest rates by 100bps. UK inflation printed at an eight-month high of 2,6% in November from 2,3% the previous month. The Bank of England (BoE) kept interest rates on hold, with a 6-3 vote.

While some domestic activity measures firmed into year end, Chinese inflation printed at 0,2% over the year from 0,3% the prior month, suggesting ongoing deflationary pressures. Chinese policy makers promised “more proactive” fiscal policy alongside “moderately loose” monetary policy, signalling more support for the ailing economy. This supported Chinese equity returns into year end.

The Bloomberg Global Aggregate Bond index lost 5,1% in the fourth quarter, bringing the return over 2024 to -1,7%. Gold consolidated in the fourth quarter after a period of strength, weakening by 0,3% but still delivered returns of circa 27% in 2024. A stronger US dollar into year-end set the tone for currency markets globally. The US dollar gained 2,6% in December, helping the greenback appreciate by 7,1% in 2024 on a trade weighted basis.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.