Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

April 2024 market review: South Africa

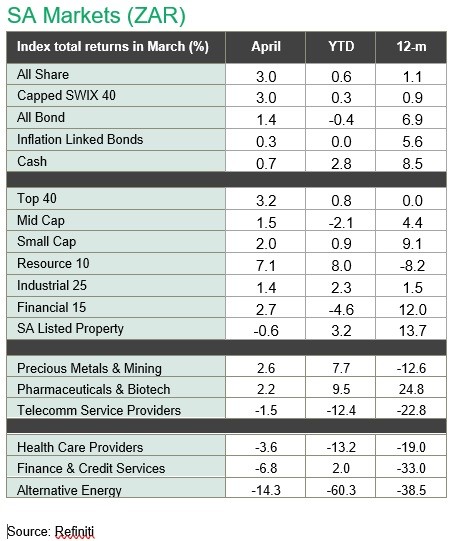

SA equities and bonds rallied in April, while the rand gained (0.5%) against the USD and was the best performing currency of the major global markets.

SA market performance and macro data:

SA equities and bonds rallied in April, while the rand gained (0.5%) against the USD and was the best performing currency of the major global markets in April. Year-to-date, the rand has depreciated by 2.9% against the US dollar.

The Capped SWIX returned to positive territory YTD (+0.3%), led by the resources sector. The All-Bond Index was up 1.4% in April and is flat year to date.

SA inflation outlook and drivers:

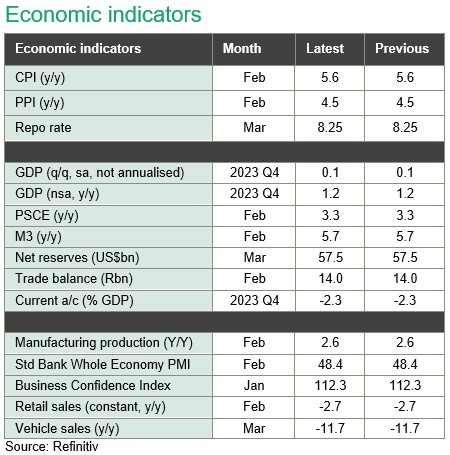

SA consumer inflation is expected to drift sideways in 2Q24 and 3Q24, before easing from 4Q24. The marked rise in maize prices has not spilled over to other food items, while the reversal of the rand and oil price spikes removes upside pressure. Food inflation and the exchange rate are the key factors to watch.

SA macro:

No load-shedding in April drove the increase in the ABSA PMI above 50, to 54 in April from 49.2 in March. The latest household credit growth number came in at 4.1% y/y but is still negative in real terms. Another trade surplus was recorded in March, with much lower (-26%) fuel import volumes more than offsetting the -15% export growth.

SA Elections:

We are monitoring the updated polling activity closely and are assessing the probabilities of three scenarios for the outcome of the South African elections. Our base case is the ANC secures around 45% of the vote and partners with a party like the IFP. Here we expect more of the same.

The negative scenario is one where the ANC obtains less than 40% and there is a shift to the left (EFF/MK) and the positive is less than 40% and a coalition with the DA. We have currently positioned client portfolios appropriately for the base-case but have investment actions prepared for either of the tail scenarios.

As always, we remain committed to providing you with the best possible investment outcomes while remaining true to our long term, well considered approach and making sure that portfolios are positioned appropriately for a variety of likely outcomes.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities:

|

Additional Information

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.