Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

July 2024 market review: South Africa

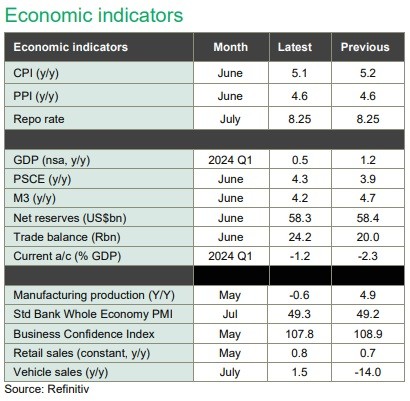

The South African macro economy's key indicators showed a mixed economic outlook during July 2024.

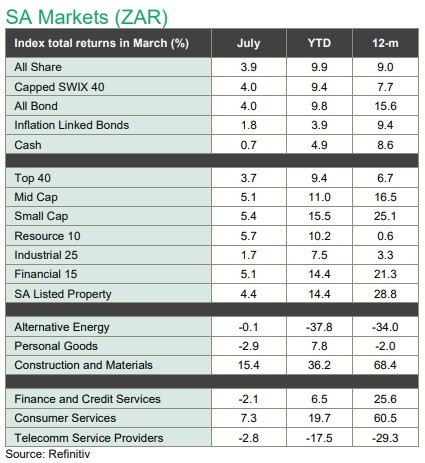

SA market performance:

SA Listed Property led asset class performance with a 4.4% return in July. Small- and Mid-Caps outperformed Large Caps, while SA Resources and Financials were the top-performing sectors. Precious Metals and Construction & Materials saw significant gains, while Telecommunications and Technology sectors posted losses.

SA Inc rallies:

While not quite the Ramaphoria market gains, there were certainly welcome share price returns from SA economy exposed companies in July. Notably Construction & Materials returned +15.4% with Raubex gaining 14.8% and WBHO gaining 12.4%. Food Producers were up +6.9% (Tigerbrands +13.8%), Drug & Grocery Stores grew +6.0% (Shoprite +7.2%, Pick n Pay +6.4%, Dis-Chem +6.3%) and the Consumer Discretionary industry group returned +1.9%. Positive total returns came from Travel & Leisure +7.4% (Southern Sun +16.2%, Famous Brands +6.4%), Consumer Services +7.3% (Curro +7.6%, AdvTech +7.2%) and Retailers +4.3% (Motus, +11.7%, Cashbuild +10.0%, Pepkor +8.9%, Italtile +8.4%, Mr Price +7.6%).

SARB rate decision:

The South African Reserve Bank (SARB) left the repo rate unchanged at 8.25% at its July meeting. The decision was split and its lower inflation forecasts have raised market expectations that the SARB will cut at its next meeting on 18 September. This will coincide with the Fed’s FOMC decision.

SA inflation outlook:

The SARB sees the inflation outlook improving modestly. For the year, headline inflation is expected to be 4.9%, slightly lower than the 5.1% expected during the May meeting. For 2025, inflation is forecast to end at 4.4% from 4.5% previously, while the 2026 forecast is unchanged at 4.5%. Our interest rate expectations have not changed: a shallow rate cutting cycle of 25bps cuts, beginning in September and over the following few MPC meetings.

SA macro:

Key indicators show a mixed economic outlook: while retail sales and consumer lending are lacklustre, a decline in food inflation and an improved ABSA PMI suggest a cyclical recovery. The trade surplus is reflective of stronger export performance and reduced fuel imports.

Consumers under pressure:

Private sector credit extension (PSCE) grew 4.3% y/y in June while growth in May was revised downwards from 4.3% y/y to 3.9% YoY. The consumer remains under pressure; household credit grew only 3.3% y/y in June (from 3.4% y/y May) and notably negative after accounting for inflation. The corporate sector appears a little more resilient with y/y growth in the total loans and advances at 5.7% y/y. The implementation of the two-pot systemshould provide some relief to consumers through anticipated debt repayments from the proceeds. Credit growth is likely to remain sluggish in the near term, which highlights the need for interest rate relief.

The strong performance of SA assets since the election took place was in line with our expectations post SA’s favourable political outcome: shortly after the election we added to SA exposed companies which has benefitted portfolios.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Our investment offering

Get an income, grow and protect your wealth with our Nedbank Private Wealth investment products and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.